It’s looking like 2025 will be a lively year for the aviation sector. The data suggest continued recovery, an uptick in profits, and the progression of new technologies. As such, industry professionals are gearing up for significant shifts. There will be challenges, for sure. But as they say, forewarned is forearmed – so, read on to find out what’s coming and stay prepared in this forward-looking piece on aviation industry trends.

1. Profitability is on the Rise

According to the International Air Transport Association (IATA), profitability across the industry is expected to increase this year. Here are several key drivers based on data reported by IATA.

Passenger Growth

Passenger demand is forecast to increase by 8.0% this year – more than the expected 7.1% capacity expansion (in ATK). There will be 4.6% more departures (totalling 40 million). The average passenger load factor is also set to increase by 0.4%.

Cargo Growth

Cargo revenues are set to increase by 6.0% in 2025. Drivers include strong e-commerce activity in Asia and shipping disruptions (including the political situation affecting shipping operations through the Suez Canal).

Freight rates will see a slight reduction but this will be offset by increased demand. (Regardless, rates will be much higher than pre-pandemic levels.)

Lower Jet Fuel Prices

Declining fuel costs will relieve pressure on operating expenses, helping airlines to improve margins. The average cost per barrel is set to reduce to USD 87, down from USD 99 in 2024. Cumulative fuel spend across airlines is forecast to drop by 4.8% despite a 6.0% increase in consumption.

2. Demand for MRO Services Will Increase

Naturally, MRO activities will grow this year. Spending is forecast to reach at least USD 282 billion, with the largest increases in commercial and military sectors, ahead of business aviation and civil helicopters.

According to Aviation Week, 150 aircraft will have passenger-to-freighter conversions this year, 200 more aircraft will be retired than in 2024, and there will be an increase in used serviceable material, which will help address supply chain challenges.

3. Supply Chain Challenges Continue

The forecast about increased profits takes into account ongoing supply chain challenges, which are limiting aircraft availability and holding back further growth. IATA reports that expected aircraft deliveries for 2025 were 2,293 but are forecast to reach just 1,802.

The backlog of unfulfilled orders for new aircraft is at 17,000 and the number of parked aircraft is around 5,000 – or 14% of the total fleet.

On top of these challenges, an aging fleet is pushing up maintenance costs and consuming more fuel than newer aircraft. Leasing rates have also increased.

Diversification of supplier bases, localisation of procurement, polling programmes, and MRO software help stakeholders manage the situation.

How Does Cloud Hosted MRO Software Help?

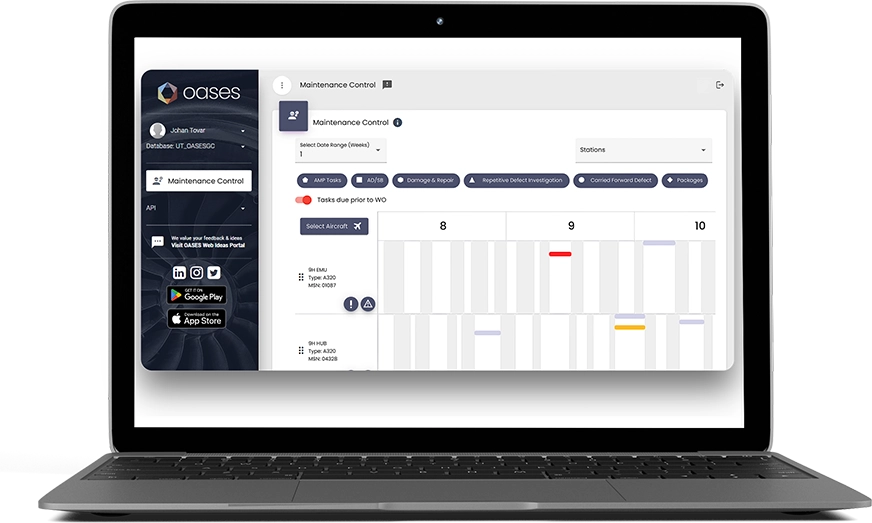

Cloud based aviation MRO software goes beyond simply tracking scheduled maintenance. It provides inventory resilience through features like intelligent stock management and efficient customs tracking. Predictive maintenance boosts efficiency here as well, helping to forecast parts requirements and resource utilization.

The best MRO software also addresses the issue of aging fleets. Its support of preventive and predictive maintenance helps to safely extend the life of assets.

4. Corporate Travel is Due to Recover

Corporate travel, which took a significant hit during the pandemic, is set to make a strong comeback in 2025.

As discussed by JTB Business Travel, reports predicted that 2025 would be the year of recovery and a Deloitte survey showed that 58% of travel managers expected their companies’ travel expenditure to increase this year. (Conferences, trade shows, and client-related travel are key drivers.)

In addition, business travel spending worldwide has now exceeded 2019 levels.

5. Airline Employment is Growing

Airline employment is forecast to reach 3.3 million this year, the growth in commercial and cargo activity creating many jobs. For example, Reuters reports that Lufthansa is aiming to recruit 10,000 people this year – this includes around 2,000 flight attendants, 800 pilots, 1,400 ground staff, 1,300 technical experts and 1,200 administrative staff.

6. Changes in Talent Acquisition and Retention

With companies looking to hire thousands of new staff, they’ll need to do more to attract talent. There are ongoing shortages for some roles, such as pilots and maintenance technicians, which may prompt companies to lure newcomers into the sector. We’ve seen this type of activity in recent years, with several major airlines putting together attractive training and employment opportunities for prospective pilots.

This trend applies across the broader aerospace and defence sector. Deloitte reports that a leading global aerospace original equipment manufacturer (OEM) estimates that the US commercial aerospace segment may need a further 123,000 technicians in the next 20 years.

Deloitte suggests that 2025 may be a pivotal year regarding talent, with AI playing a significant role in enhancing talent strategies. It’s expected that to attract candidates, companies will be offering higher-than-average wages and enabling technicians and engineers to use complex technologies.

7. The Use of AI Will Expand

Deloitte’s research suggests that Artificial Intelligence will be used more extensively in 2025. 81% of survey respondents in aerospace and defence said they’re already using, or plan to use AI and machine learning technology.

In terms of maintenance tasks, some companies are already using AI in one-off areas such as predictive maintenance, but it’s likely to be used more widely this year. Key focus areas will include inventory optimisation, capacity management, operational flight management, and resource allocation.

8. The Use of Unmanned Aerial Systems Will Expand

Unmanned Aerial Systems (UAS) are set to expand in the US. The Federal Aviation Administration (FAA) have now authorised Dallas delivery companies, including Zipline and Wing, to operate simultaneous beyond visual line of sight (BVLOS) flights.

Previously, pilots had to keep their drones in visual line of sight at all times. But, thanks to UAS traffic management technology (UTM), this change is possible. UTM systems allow operators to share data on planned flights and routes to ensure safety. The technology was first tested in Dallas in 2023.

Is this just the start? Will more delivery companies around the US and beyond be authorised to follow suit? Time will tell. However, the US commercial drone market itself is showing promise.

9. eVTOL Aircraft May Enter Commercial Service

Electric Vertical Take-Off and Landing (eVTOL) aircraft are expected to have their debut for commercial use this year. Abu Dhabi may be the first place in which they are used to transport passengers.

Progress is underway in the US as well thanks to updated regulations, and several companies may start their passenger services in 2025. California-based Joby Aviation operates eVTOL aircraft that can reach 200 mph and hold four passengers, and plans to begin services towards the end of the year.

eVTOLs will transform short-distance travel in congested urban areas, offering a sustainable alternative to traditional transport. Of course, new aircraft maintenance frameworks, viable pricing models and expanded charging infrastructure will be required in order for services to scale significantly.

Conclusion

Things are looking positive on the whole for 2025 – fuel costs have dropped, and passenger travel and cargo demand will rise. In turn, so will profits. Some exciting developments regarding drones and eVTOL aircraft are also on the horizon.

Growth will be moderated by ongoing supply chain challenges, and maintenance teams will have their work cut out for them. Stakeholders will need to address issues relating to capacity and staffing.

Aviation MRO software is one of the keys to maintaining operational excellence as demand increases. OASES is a world class, end-to-end solution for managing every facet of maintenance and is used by airlines, MRO providers and CAMOs in 55 countries across six continents. To learn more or request a demo, contact us today. And Happy New Year!

To learn more or book an OASES demo, contact us today

For organisations looking to ascend to new heights of operational excellence, contact us today to book a demo.